Linked Benefit Products

Also called asset based long term care insurance or hybrid policies. These are an alternative to standard long term care insurance.

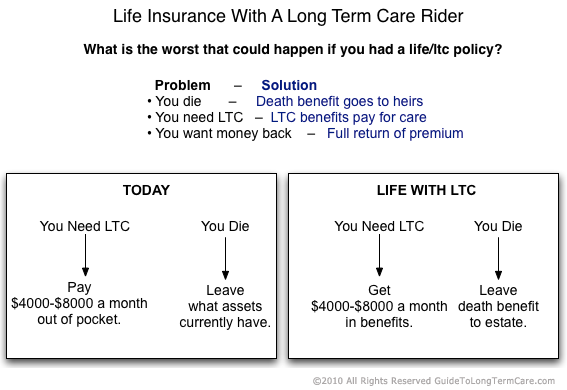

Life Insurance with a Long Term Care Rider

Life insurance and long term care benefits in one product to help you manage your assets now so you can enjoy financial freedom later. Your premium payment provides a pool of benefit dollars available for long term care for you, or a death benefit for your beneficiaries, or both. Life with LTC coverage is available from different companies and depends on your payment method: Single premium, 10-pay, or lifetime pay (like other insurances) and source of money (Cash or Qaulified).

More about the Life/LTC option. --->

Annuity with a Long Term Care Rider

There are two types of annuities with long term care benefits, one you buy before you need care "Single Premium Deferred Annuity" (SPDA) and one if care is already needed, the Single Premium Immediate Annuity" (SPIA). The idea behind the SPDA product is to pair the safety and tax-deferred growth of a single premium deferred annuity (SPDA) with long term care (LTC) coverage. With a few simple choices, you can leverage assets to create a larger pool of benefit dollars available for comprehensive long term care.

More about the Annuity/LTC option. --->

| if you are over 59 1/2 and don't need the money for income you can use your Qualified (IRA, 401k) money to fund the premium. This is a great way to use your IRA 401k to cover future long term care costs and if you don't need care your estate gets the money. Check with us if this is available in your state. |

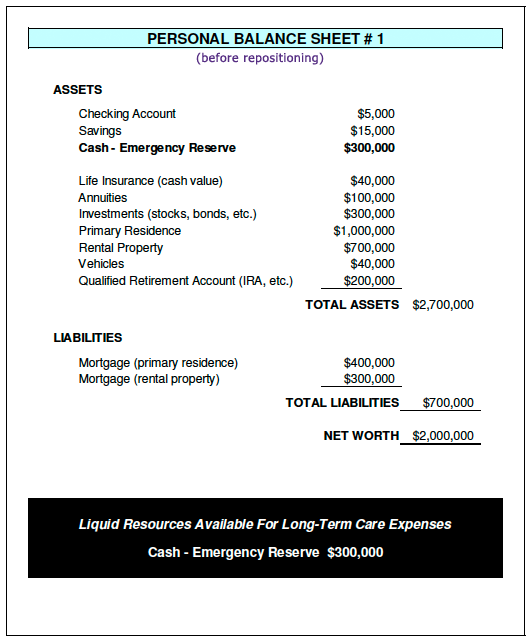

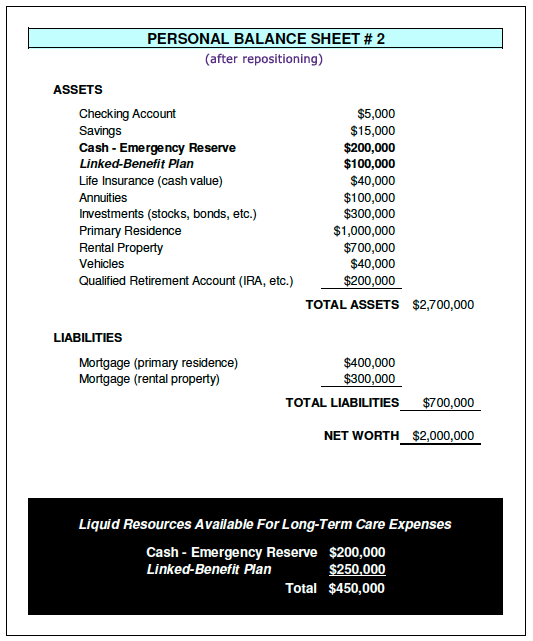

Repositioning cash greatly increases funds if long term care is needed.

Q: How do I find out if this is right for me?

A: Thousands of Americans just like you have decided to protect their nest egg. Call us, email us or fill out our online form and one of our licensed specialists will answer all your questions.

CLICK HERE TO GET A FREE QUOTE TODAY!