Life Insurance With Long Term Care Benefits

A popular alternative to standard LTC insurance and refered to as a linked benefit product or Asset Based insurance

Are you looking for a way to leverage your investments to include protection from the risk of expensive long term care?

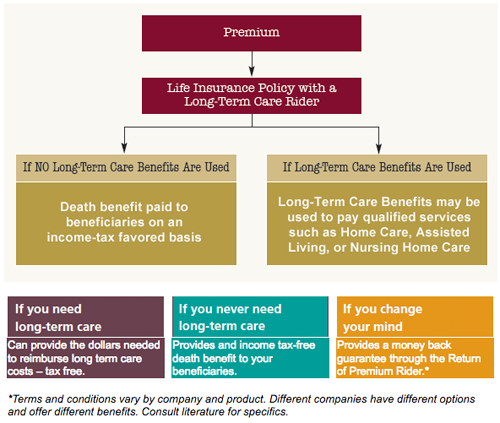

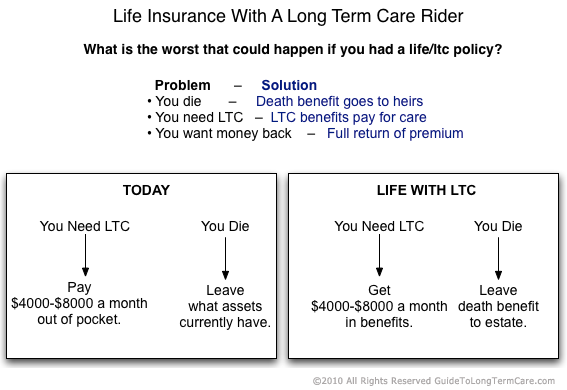

- Helps you pay for long-term care if you need it

- Provides an income tax-free death benefit if you don’t

- Offered with a money back guarantee

- Protect your retirement income from the risk of long-term care expenses

|

You can reposition existing money such as CDs, Money Market, Savings, or you can 1035 exchange an existing universal/whole life insurance policy. See the Pension Protection Act for more information. Q: Can I use my IRA money or one of my old 401k's to fund the annuity? Contact us to find out if this is appropriate for your needs. This product requires health underwriting. If you cannot health-qualify annuities with LTC benefits have less strict underwriting. |